In finance, Free Cash Flow (FCF) is perhaps the single most important measure of a company’s financial success and viability. It refers to the amount of cash a business has left over after meeting its operating expenses and capital expenditures. Put simply, free cash flow indicates how much actual cash a company has available for investors, lenders, and the business owner after paying for the routine operating costs and buying items for business use.

For institutional and retail investors and analysts, cash flow can be an essential metric in analyzing a business’s actual profitability and growth potential. Cash flow is distinct from accounting profits because it indicates actual cash generated the lifeblood of the business and can be impacted by non-cash accounting estimates or assumptions.

What Is Free Cash Flow?

Free Cash Flow is the total cash remaining after the business pays for operating expenses and capital expenses. It gauges if the company has enough cash on hand to pay dividends, repurchase shares, pay down debt, or reinvest in growth projects.

In mathematical form, Cash Flow can be calculated from:

Free Cash Flow (FCF) = Operating Cash Flow – Capital Expenditure

That is, once the company has received cash from operations and has spent an appropriate amount on investment in assets or infrastructure, what is left is free cash flow (FCF) or simply cash on hand with discretionary ability. Simply, a positive cash flow means surplus cash at the disposal of the company, with a negative FCF indicating that expenses or reinvestments were greater than income.

Types of Free Cash Flow

Free cash flow to the firm (FCFF)

FCFF indicates the cash flow available to providers of capital (both debt holders and equity holders) after all operating expenses and investments have been made. It is a way to indicate how efficiently a business creates cash available to pay interest, repay debt, or pay dividends.

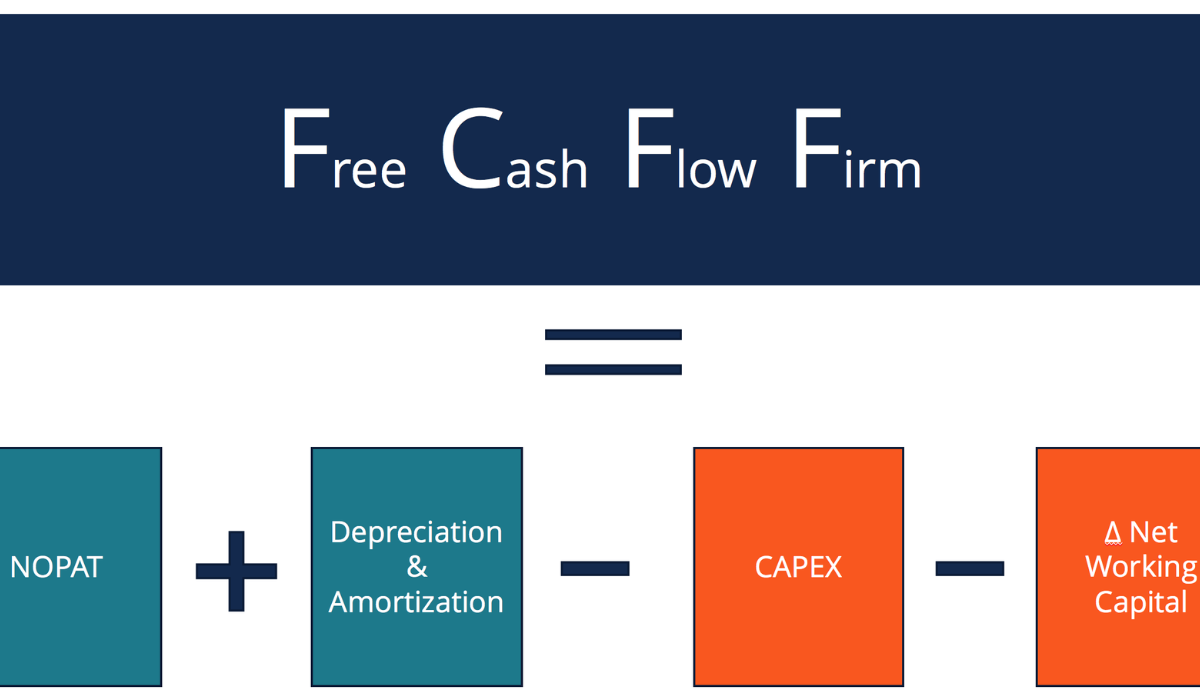

Formula:

FCFF = Operating Cash Flow – Capital Expenditure

A high FCFF indicates that the business is producing cash efficiently and can meet its obligations, which will be attractive to investors and lenders.

FCFE (Free Cash Flow to Equity)

FCFE is the cash available for equity shareholders after accounting for expenses, debt, and reinvestments. FCFE is often referred to as “levered cash flow.”

Formula:

FCFE = FCFF + Net Borrowing – (Interest × (1 – Tax Rate))

This benefit allows investors to understand how much cash is available for dividends or share buybacks. If a company consistently sees cash flow to equity increase, most likely that company is healthy enough to reward shareholders.

How to Calculate Free Cash Flow

To calculate cash flow, analysts usually start from the operating cash flow on the income statement. The operating cash flow comes straight from such statements, which show expenses and revenues for a period of time along with balance sheets and cash flows (operating, investing, financing).

Here is an example of the general formula:

FCF = Operating Cash Flow – Capital Expenditure Alternatively,

when data is not directly available, cash flow can also be estimated through alternative methods.

- FCF = Sales Revenue (Operating Costs + Taxes) Investment in Operating Capital

- Cash flow = Net Operating Profit After Tax – Change in Working Capital – Capital Expenditure

This variation method can let analysts calculate cash flow even when some investment-related variables are not directly reflected in financial statements.

Read more: HRMS Medicover | ViralTips Online

Example of Free Cash Flow Calculation

Let’s take an example to understand this better. If a company has the following financial data:

Operating Cash Flow: Rs180,000,000.00

Capital Expenditure: Rs75,000,000.00

Then

Cash Flow = 180000000 – 75000000 = 105000000

This means the company has Rs10.5 million of cash flow left after all its operational and capital needs are met. This type of strong cash flow reserve allows the company to invest in new projects, repay loans, or distribute dividends.

Why Is Free Cash Flow Important?

Free Cash Flow is a powerful measure because it reveals what profits alone cannot: the actual cash efficiency of a business. Here’s why it counts:

Financial Flexibility

Companies with high free cash flow are free meanwhile to invest, innovate, and grow without ever having to turn to the market for funds.

Investor Confidence

Investors prefer firms with steady or rising FCF, as it becomes shorthand for sustainable earnings and the potential for higher dividends.

Debt Management

High free cash flow levels in a company facilitates quicker repayment of existing debts, leading to better credit ratings and reduced interest charges.

Valuation Metric

Numerous valuation models, such as the Discounted Cash Flow (DCF) model, depend heavily on FCF to assess a company’s inherent value.

Factors Influencing Free Cash Flow

Cash flow can change due to many possible operational or strategic measures. Some common factors include:

Increase in Free Cash Flow

It typically goes up when:

- The company sells assets or cuts capital spending.

- Collection of receivables is up.

- Operational efficiency improves.

- Profit margins widen.

Decrease in Free Cash Flow

Its decrease may be caused by:

- Increase in working capital requirements.

- Lower operating income or delays in the payment.

Understanding these trends helps analysts judge a company’s cash flow to get either healthy growth or questions raised. The course tries to track the relationship between a company’s net operating profit and cash flow from operations.peek

Advantages of Free Cash Flow

For Investors

- Free cash flow offers investors a way to determine whether a company will perform well over time.

- It tells them whether dividends could be covered by real money rather than just accounting profits.

- Businesses that can increase their cash flow sequentially and expand their gross margins are nicely run operations under competent management.

It also indicates business effectiveness over time, when we consider both short-and long-term results together. s stop above under administration usually signifies the latter

For Creditors

- Creditors use cash flow measurements to see if the com- pany has enough left after reinvesting to make debt payments.

- A strong FCF reduces the risk of borrowing, and banks are more willing at preferential rates to lend to companies with high FCF.

For Business Owners and Partners

- Entrepreneurs analyze cash flow to decide where to expand, merge or buy.

- It ensures that the business has enough capital to meet operating and strategic goals.

Disadvantages of Free Cash Flow

Although free cash flow is an important measure, it does have certain limitations:

- Annual Variation: Capital expenditures vary year to year and across industries, which makes comparisons of FCF difficult.

- Misleadingly High Cash Flow: A very high cash flow could indicate that a company is underinvesting in future growth.

- Misinterpretation of Low Cash Flow: Sometimes a low or negative cash flow will not show poor performance and is just a result of high reinvestment during an expansion stage.

So, analysts need to constantly consider both FCF and other ratios for context in full.

Free Cash Flow vs. Net Income

| Basis | Free Cash Flow | Net Income |

|---|---|---|

| Definition | Actual cash available after capital expenses | Profit after accounting adjustments |

| Focus | Liquidity & cash efficiency | Accounting profitability |

| Reliability | More accurate for valuation | May include non-cash items |

| Usage | Used in DCF valuation and investment analysis | Used in profit-loss reporting |

Conclusion

In conclusion, cash flow is one of the most dependable measures of a company’s financial health. It tells you whether a company can efficiently turn revenues into real, usable cash that can be reinvested for growth, paid to shareholders in dividends, or used for overall growth and stability.

While a company may show attractive profit figures, cash flow demonstrates the true ability of a business to operate efficiently. For investors, creditors, and business leaders, cash flow is a way to assess the operational and future viability of the organization.

(FAQs)

Why is Cash Flow important?

Ans: It indicates how much actual cash the business generates after all of its costs. A positive cash flow means it is a healthy business that is able to fund its own operations.

What does negative cash flow indicate?

Ans: Negative cash flow generally signals higher-than-normal capital expenditures or inefficiencies in the operation of the business. It also could signify the business is engaged in significant growth capital expenditures.

How is cash flow different from EBITDA?

Ans: EBITDA calculates earnings before interest, taxes, depreciation, and amortization are calculated, while cash flow looks at actual free cash available to the business (after capital expenditures).

What is considered to be a good cash flow yield?

Ans: Typically, a Cash Flow (FCF) yield greater than 4% would be considered good, and an FCF yield over 7% may indicate that the business is a potentially high-return investment.

Does cash flow indicate business growth?

Ans: Yes! Increased levels of cash flow, if sustained, typically indicate good management and potential for future growth.